How much does it cost each household?

A frequently asked question is “What is the parish precept?”. This is described in detail here, but in short, when West Wratting Parish Council (WWPC) needs to pay for something the funds for that come from people who live in the village as part of their council tax payment, called “the precept”.

I’ve done some calculations to give estimates of the impact of precept on individual households. This doesn’t take into account discounts for single occupancy properties (because that’s not publicly available, as far as I can tell) so the numbers won’t be perfectly correct, but I think they’ll be a good guide.

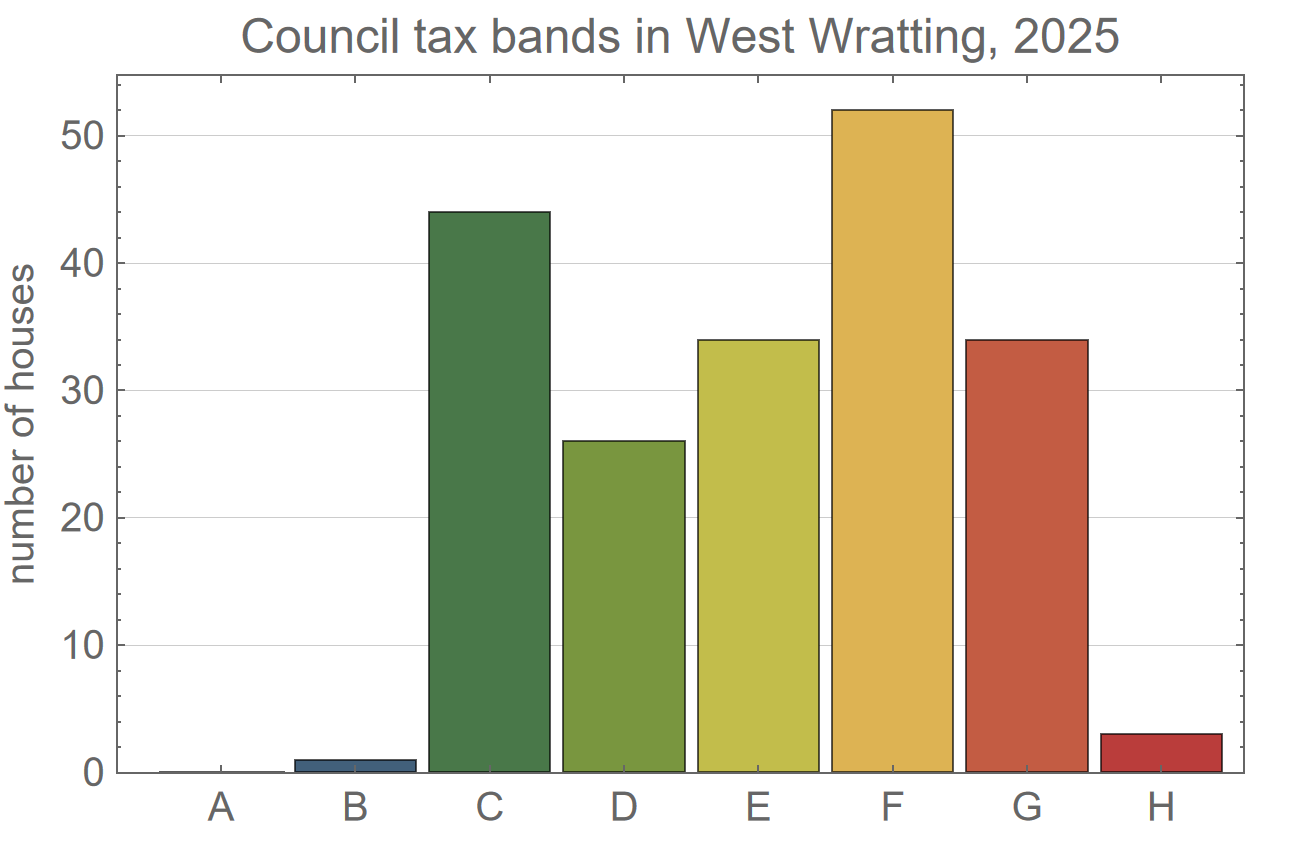

I needed to do some googling to find the distribution of houses in different council tax bands in West Wratting in 2024. It took a bit of searching using a list of all postcodes in West Wratting (from https://www.doogal.co.uk/Parish?parish=E04001851) and then using https://www.tax.service.gov.uk/check-council-tax-band, but it gave these values:

| Band | A | B | C | D | E | F | G | H |

| Number | 0 | 1 | 44 | 26 | 34 | 52 | 34 | 3 |

From these figures there are a total of 194 properties in West Wratting, with this distribution.

Again, these data might not be perfect but will be pretty close.

You also need to know the relative charges for each council tax band, which are the ratios shown at https://www.cambridgeshire.gov.uk/council/finance-and-budget/council-tax/council-tax-bands

Relative to band D these are:

| Band | A | B | C | D | E | F | G | H |

| Weighting | 6 | 7 | 8 | 9 | 11 | 13 | 15 | 18 |

| Ratio | 6 / 9 | 7 / 9 | 8 / 9 | 9 / 9 | 11 / 9 | 13 / 9 | 15 / 9 | 18 / 9 |

A bit of maths (see footnote) then gives the following impacts on individual households.

| Band | cbh | cbh |

| A | 6/2207 | 0.0027 |

| B | 7/2207 | 0.0032 |

| C | 8/2207 | 0.0036 |

| D | 9/2207 | 0.0041 |

| E | 11/2207 | 0.005 |

| F | 13/2207 | 0.0059 |

| G | 15/2207 | 0.0068 |

| H | 18/2207 | 0.0082 |

The contribution by house (cbh) value is shown as a fraction value and by an approximate decimal.

What this means, is that if we wanted to increase the precept by £1 for some particular purpose, each band D house would contribute £0.0041, so 0.41p. For a higher amount just multiply. For example, the contribution of a band D house towards a precept amount of £1500 to pay for something would be 1500 x 0.0041 = £6.12. So if we wanted to increase the precept by £1500 for the year to pay a contribution to the village hall running costs, for example, each band D house would be contributing about £6.00 towards that, or about the price of just one pint for the entire year.

What is the total precept for West Wratting?

This figure can be found from the Annual Governance and Accountability Return (AGAR) that is published each year by WWPC, links to which can be found on the Audit Reports page. The Annual Accounting Statement (AGAR page 6) for 2023/24 shows that the precept for 2024 was £13,110. This means a band D house contributed £53.75 towards the parish precept.

Simon Chandler

West Wratting Parish Council

Footnote: Here’s how to get the values shown. The council tax weightings are 6, 7, 8, 9, etc. shown above. The contribution by house (cbh) value will be proportional to these weights, but divided by the sum of number of houses in each band multiplied by the weighting of each band, i.e.,

The denominator in this is 2207 for West Wratting using the number of houses in each band that I found on the internet.